Disclaimer: New EUDR developments - December 2025

In November 2025, the European Parliament and Council backed key changes to the EU Deforestation Regulation (EUDR), including a 12‑month enforcement delay and simplified obligations based on company size and supply chain role.

Key changes proposed:

These updates are not yet legally binding. A final text will be confirmed through trilogue negotiations and formal publication in the EU’s Official Journal. Until then, the current EUDR regulation and deadlines remain in force.

We continue to monitor developments and will update all guidance as the final law is adopted.

De EU Ontbossingsverordening (EUDR) is een nieuwe wet gericht op het bestrijden van ontbossing door ervoor te zorgen dat bepaalde grondstoffen en producten ontbossingsvrij en legaal geproduceerd zijn.

Voor handelaren - bedrijven die producten binnen de EU kopen en doorverkopen zonder ze te transformeren - begint de EUDR-compliance op 30 december 2025 voor grote en middelgrote bedrijven, en op 30 december 2026 voor kleine en micro-ondernemingen - zoals uiteengezet in het laatste EUDR-voorstel van de Europese Commissie, dat nog goedkeuring van het Parlement moet krijgen.

Handelaren spelen een cruciale rol in dit systeem en dragen de verantwoordelijkheid om traceerbaarheidsinformatie door de hele toeleveringsketen te behouden en door te geven. Hun rol is nog belangrijker gezien hoe gefragmenteerd de grondstoffenmarkten zijn, vaak met meerdere lagen van tussenpersonen voordat producten de eindmarkt bereiken. In deze gids leggen we uit wat EUDR voor handelaren betekent en geven we praktische stappen van het identificeren van je rol tot het voorbereiden op audits om je te helpen aan de nieuwe eisen te voldoen.

Onder EUDR worden handelaren gedefinieerd als bedrijven die producten binnen de EU-markt beschikbaar maken nadat ze al door iemand anders op de markt zijn gebracht. Simpel gezegd, als je gereguleerde grondstoffen binnen de EU koopt en verkoopt (zonder de eerste importeur, producent, exporteur of fabrikant te zijn), ben je een handelaar. Het verschil ligt in je rol in de toeleveringsketen. Operators behandelen de initiële invoer van goederen (zoals gedefinieerd in HS-codes), terwijl handelaren goederen na die initiële invoer behandelen (meestal als distributeurs, groothandelaars of detailhandelaren die inkopen bij EU-gebaseerde leveranciers).

Ter illustratie, hier zijn twee praktijkvoorbeelden van handelaren:

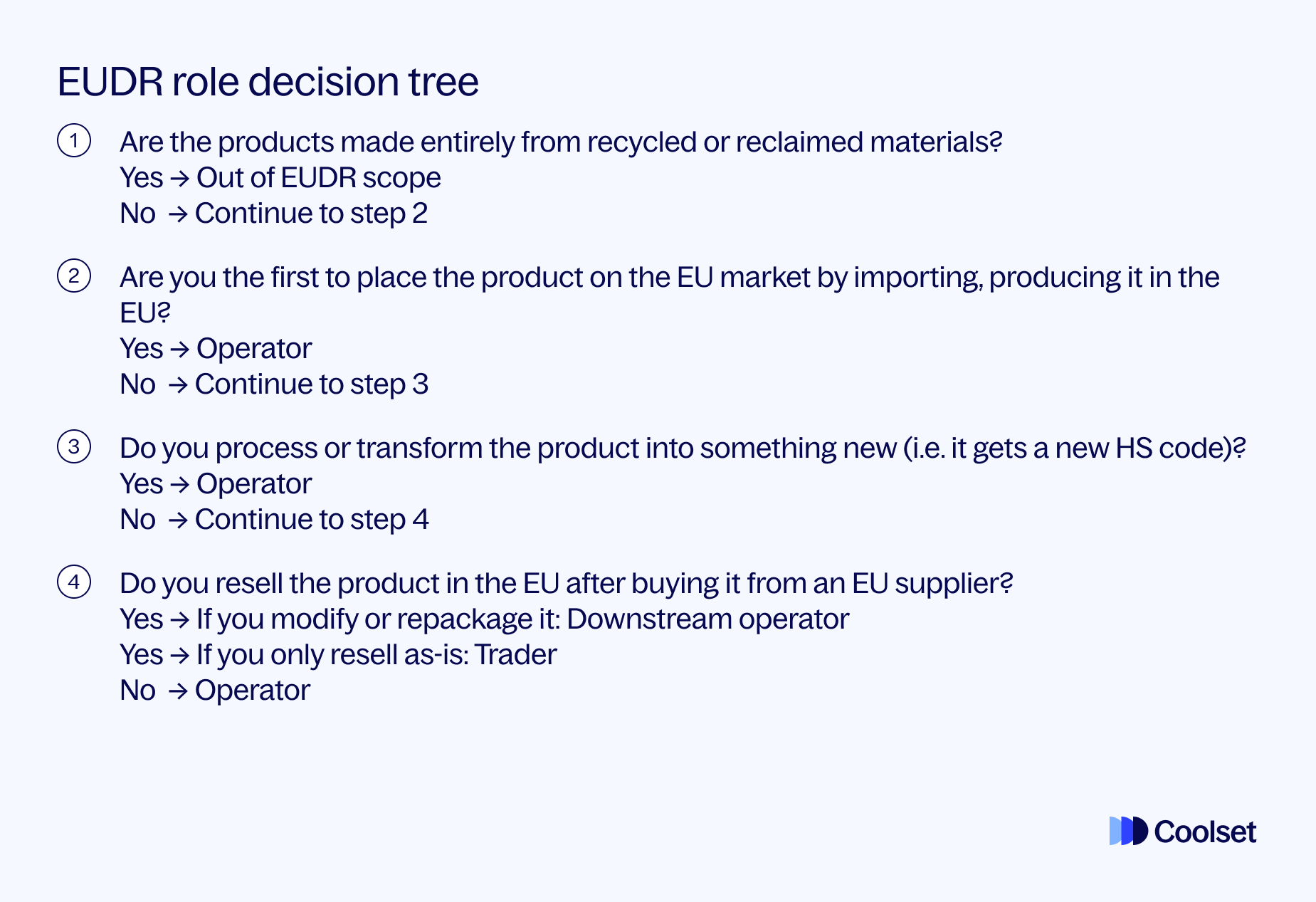

Hier is een praktische checklist om te controleren of je als handelaar of operator wordt beschouwd onder de EUDR.

Hoewel handelaren niet het volledige due diligence-proces uitvoeren zoals operators, legt de EUDR nog steeds belangrijke rapportage- en traceerbaarheidsverplichtingen op hen. De exacte verantwoordelijkheden variëren afhankelijk van de grootte van je bedrijf.

Als je geen MKB bent, behandelt de EUDR je effectief als een downstream operator. In feite hebben niet-MKB handelaren dezelfde kernverplichtingen als grote operators.

Je verantwoordelijkheden in een notendop:

Echter, niet-MKB handelaren kunnen profiteren van een vereenvoudigde vorm van due diligence. Als je kunt vaststellen dat je upstream leverancier een goede due diligence heeft uitgevoerd, kun je hun DDS hergebruiken en verwijzen in je eigen indiening. Zelfs bij het verwijzen naar een upstream DDS blijf je wettelijk aansprakelijk als de due diligence onvolledig of onjuist was, dus het is in je belang om leveranciers zorgvuldig te beoordelen en te documenteren waarom je hun DDS vertrouwde.

De EUDR biedt kleine handelaren een lichtere last. MKB handelaren hoeven geen due diligence uit te voeren of hun eigen DDS in te dienen zolang het product al door een DDS is gedekt. Ze hebben echter wel belangrijke traceerbaarheidsverantwoordelijkheden.

Kort gezegd moet je als MKB handelaar:

In wezen verwacht de wet dat kleine handelaren de keten van eigendomsinformatie behouden. Als een MKB handelaar vermoedt dat een product mogelijk niet compliant is (bijvoorbeeld als er documentatie ontbreekt of er rode vlaggen zijn), zijn ze verplicht om onmiddellijk de autoriteiten te informeren.

Geen enkele handelaar, ongeacht de grootte, mag bewust handelen in niet-conforme goederen. Het verkopen van een product waarvan je weet (of zou moeten weten) dat het gelinkt is aan illegale ontbossing zou de EUDR schenden.

Handelaren fungeren in wezen als de compliance-brug in de toeleveringsketen: tegen de tijd dat een product een eindgebruiker bereikt, moet er een duidelijke digitale spoor zijn naar een conforme bron. Dit betekent robuuste administratie en het vermogen om documentatie op verzoek te produceren.

{{custom-cta}}

Om meer te leren over de EUDR-vereisten voor MKB's, bekijk onze rapportagegids voor MKB's.

In oktober 2025 stelde de Europese Commissie wijzigingen voor die de verantwoordelijkheden van niet-MKB handelaren, MKB handelaren en downstream operators onder hetzelfde vereenvoudigde kader zouden brengen. Onder dit voorstel zouden zowel niet-MKB als MKB handelaren, evenals downstream operators, dezelfde kernverplichtingen hebben:

Ze zouden niet langer verplicht zijn om hun eigen DDS in te dienen, zelfs als ze geen MKB zijn, zolang de upstream operator er al een heeft ingediend. De reden achter deze verandering is om duplicatie en administratieve lasten te verminderen, ervoor te zorgen dat er minder DDS voor hetzelfde product door de keten worden ingediend, wat op zijn beurt voorkomt dat het TRACES-informatiesysteem overbelast raakt terwijl toch volledige traceerbaarheid door de toeleveringsketen behouden blijft.

Voldoen aan de EUDR als handelaar vereist een mix van verificatie, documentatie en interne coördinatie. Hieronder vind je een stapsgewijze gids voor zowel MKB- als niet-MKB-handelaren, met notities over wat MKB's kunnen overslaan.

Begin met verifiëren dat je als handelaar optreedt. Bevestig vervolgens of je kwalificeert als een MKB volgens de EUDR-definitie. Dit onderscheid is cruciaal: MKB's hebben beperkte verplichtingen, terwijl niet-MKB-handelaren due diligence-stappen moeten volgen die vergelijkbaar zijn met die van operators. Dit bepaalt welke van de volgende stappen op jou van toepassing zijn.

Maak een lijst van alle producten en grondstoffen die je verhandelt en controleer welke onder de EUDR vallen. Breng vervolgens je toeleveringsketen voor die producten in kaart. Begrijp wie je leveranciers zijn, waar de producten vandaan komen en hoe je upstream toeleveringsketen eruitziet. Deze basis is essentieel voor traceerbaarheid, risicobeheer van non-compliance en auditgereedheid.

Je interne systemen moeten overeenkomen met je grootte en verplichtingen

Niet-MKB-handelaren moeten een gedocumenteerd due diligence-systeem opzetten, inclusief:

MKB-handelaren hebben geen formeel systeem nodig, maar moeten wel een duidelijke, toegankelijke manier hebben om:

Niet-MKB-handelaren moeten "vaststellen" dat due diligence correct is uitgevoerd door hun leverancier, maar de wet definieert niet precies hoe dit moet. We raden aan om een leveranciersrijpheidsbeoordeling uit te voeren om hun EUDR-gereedheid te evalueren.

Belangrijke niet-uitputtende criteria zijn onder andere:

Deze beoordeling helpt je beslissen of je het DDS van de leverancier kunt vertrouwen en hergebruiken of dieper moet graven. Als de rijpheidsbeoordeling niet voldoende vertrouwen biedt dat de due diligence van de leverancier correct is uitgevoerd, raden we aan om door te gaan met het volledige proces en zelf een juiste due diligence uit te voeren.

Alle handelaren moeten gegevens verzamelen, maar de omvang hangt af van je grootte. Ongeacht de grootte van je bedrijf moet je gegevens verzamelen over:

Als je een niet-MKB-handelaar bent die een upstream DDS hergebruikt, moet je naast het bovenstaande ook verzamelen:

Voordat je een product verkoopt, moet je een DDS indienen via het Informatiesysteem van de EU. Als je een DDS van een leverancier hergebruikt, verwijs je ernaar in je eigen DDS en sta je in voor de geloofwaardigheid ervan.

Traceerbaarheid staat centraal in de EUDR. Of je nu een MKB bent of niet, je moet elk product dat je verhandelt kunnen traceren naar zijn oorsprong en het kunnen bewijzen.

Zo ziet dat er in de praktijk uit:

Tip: Bouw je systeem rond "trace-back" logica. Vraag jezelf af: als iemand dit product van een plank haalt, kun je het dan helemaal terug traceren naar de boerderij of het bos waar het is geteeld of geoogst?

Voor MKB-handelaren kan het opzetten van een traceerbaarheidssysteem relatief eenvoudig zijn. Een goed georganiseerde database is vaak voldoende zolang deze duidelijk leveranciersnamen, DDS-referenties en productbatches koppelt.

Voor niet-MKB-handelaren vereisen de schaal en complexiteit van de operaties echter meestal een meer gestructureerde aanpak. Grotere bedrijven moeten mogelijk gespecialiseerde software voor toeleveringsketen of compliance adopteren die producten verbindt met hun corresponderende DDS en indien nodig geolocatiegegevens en ondersteunende documentatie in één gecentraliseerd systeem.

Belangrijk: Vergeet niet dat je alle traceerbaarheidsrecords ten minste vijf jaar moet bewaren en klaar moet zijn om ze te delen als daarom wordt gevraagd tijdens een audit.

EUDR-audits zijn geen hypothetische situaties, ze maken deel uit van het handhavingsplan. Als handelaar betekent voorbereid zijn weten waar je documenten zijn, hoe je er snel toegang toe krijgt en aantonen dat je systemen in de praktijk werken.

Dit is wat autoriteiten doorgaans controleren:

Voor niet-MKB-handelaren zullen audits ook je due diligence-systeem bekijken, dus houd het gedocumenteerd en up-to-date. Voor MKB's ligt de focus op traceerbaarheid: zolang je de juiste leverancier- en DDS-informatie kunt verstrekken, sta je op solide grond.

Tip: Gebruik auditvoorbereiding als een kans om je interne processen te verbeteren. Hoe beter je documentatie vandaag stroomt, hoe eenvoudiger compliance morgen zal zijn.

De Europese Commissie heeft updates voorgesteld die de verplichtingen voor niet-MKB-handelaren aanzienlijk kunnen verminderen. Als ze worden aangenomen, hoeven niet-MKB-handelaren hun eigen due diligence-verklaring (DDS) niet meer in te dienen als het product al wordt gedekt door een upstream DDS. Dit betekent dat stappen 3, 4 en 6 van de huidige opzet overbodig zouden zijn. Tegelijkertijd zou stap 5 worden gereduceerd tot een enkele kernverantwoordelijkheid: het verzamelen, opslaan en doorgeven van DDS-referentienummers of verklaringsidentificatoren van je upstream leveranciers. Het voorstel wordt beoordeeld door het Europees Parlement en de Raad en is nog niet juridisch bindend. Totdat het is afgerond, moeten handelaren zich blijven voorbereiden volgens de huidige regels.

Zelfs goedbedoelende handelaren kunnen struikelen als het gaat om EUDR-compliance. Hieronder staan enkele van de meest voorkomende misvattingen die we hebben waargenomen, samen met praktische manieren om ze te vermijden.

Aannemen dat leveranciers volledig compliant zijn zonder je eigen controles uit te voeren, kan schadelijk zijn. EUDR legt de verantwoordelijkheid bij elk bedrijf om ervoor te zorgen dat de producten die ze verhandelen ontbossingsvrij en legaal zijn.

Hoe het te vermijden: Voer een leveranciersrijpheidsbeoordeling uit om de betrouwbaarheid van de due diligence-processen van je leveranciers te evalueren. Dit omvat het controleren op eerdere compliance-overtredingen en ervoor zorgen dat documentatie beschikbaar, compleet en geloofwaardig is.

Belangrijk:

Op basis van het voorstel van oktober 2025 zouden handelaren, zowel MKB als niet-MKB, niet langer verplicht zijn om de due diligence-processen van hun leveranciers te beoordelen of te verifiëren.

Onder de voorgestelde wijzigingen kunnen downstream handelaren vertrouwen op een geldig due diligence-verklaring (DDS) of verklaringsidentificator van een upstream operator zonder aanvullende controles of rijpheidsbeoordelingen uit te voeren.

Zelfs nadat je de betrouwbaarheid van je leverancier hebt beoordeeld, kan het alleen vertrouwen op de gegevens die ze verstrekken zonder onafhankelijke verificatie nog steeds riskant zijn. Blind vertrouwen is niet genoeg; handelaren moeten actief de nauwkeurigheid en volledigheid van de ontvangen gegevens bevestigen.

Hoe het te vermijden: Voer steekproeven uit op de gegevens in een due diligence-verklaring die je hergebruikt. Dit kan het verifiëren van coördinaten, het controleren van documentconsistentie of het vragen om verduidelijkingen van de leverancier omvatten waar nodig.

Belangrijk:

Op basis van het voorstel van oktober 2025 zouden handelaren mogen vertrouwen op de due diligence-verklaring (DDS) of verklaringsidentificator die ze van hun leveranciers ontvangen zonder onafhankelijke verificatie of steekproeven uit te voeren. Zelfs onder deze vereenvoudigde aanpak blijft het echter een goede gewoonte om de DDS-informatie die je ontvangt te valideren. Tools zoals Coolset's EUDR-compliance software kunnen je helpen automatisch te verifiëren dat een DDS-nummer legitiem, actief en correct gekoppeld is aan de specifieke producten of zendingen die je hebt gekocht, waardoor een extra laag van zekerheid wordt toegevoegd en mismatches of verlopen records worden gemarkeerd voordat ze compliance-risico's worden.

Sommige handelaren denken ten onrechte dat het zijn van een MKB hen vrijstelt van alle EUDR-vereisten. Hoewel MKB's verminderde verplichtingen hebben, moeten ze nog steeds traceerbaarheid behouden en informatie op verzoek verstrekken.

Hoe het te vermijden: Beoordeel regelmatig de capaciteit van je bedrijf om EUDR-gerelateerde informatie te verzamelen en te delen. Zelfs als MKB moet je belangrijke records bewaren en klaar zijn om op elk moment traceerbaarheid te bewijzen.

Ongeorganiseerde of ontbrekende records kunnen leiden tot compliance-fouten. EUDR vereist dat handelaren gedetailleerde records bijhouden van hun toeleveringsketens, inclusief leveranciersidentiteiten, due diligence-verklaringen en transactiegeschiedenis voor ten minste vijf jaar.

Hoe het te vermijden: Gebruik digitale tools om gegevensverzameling en opslag te automatiseren. Zorg ervoor dat elk product duidelijk is gekoppeld aan zijn DDS en leverancier. Houd bestanden gemakkelijk toegankelijk voor audits

Niet-MKB-handelaren gaan er soms van uit dat ze minder toezicht zullen krijgen dan operators. Integendeel, EUDR behandelt niet-MKB-handelaren expliciet als gelijkwaardig aan operators vanwege hun aanzienlijke invloed op de markt

Hoe het te vermijden: Als je een niet-MKB bent, behandel EUDR-compliance met dezelfde diepgang als een downstream operator zou doen. Dit omvat het bijhouden van up-to-date records en ervoor zorgen dat alle compliance-maatregelen grondig worden gevolgd en gedocumenteerd.

Belangrijk:

Hoewel het voorstel van oktober 2025 de verplichtingen voor niet-MKB-handelaren zou verminderen, moet je nog steeds volledige traceerbaarheidsrecords bijhouden, DDS of verklaringsidentificatoren doorgeven en samenwerken met audits door bevoegde autoriteiten. Vereenvoudigde taken verwijderen het toezicht niet, handelaren moeten audit-gereed blijven en in staat zijn om continue traceerbaarheid te bewijzen

EUDR-compliance eindigt niet wanneer je documenten hebt verzameld of een DDS hebt ingediend. Audits zijn een belangrijk onderdeel van handhaving en voorbereid zijn betekent interne processen opbouwen die je verantwoordelijkheden weerspiegelen en bestand zijn tegen controle.

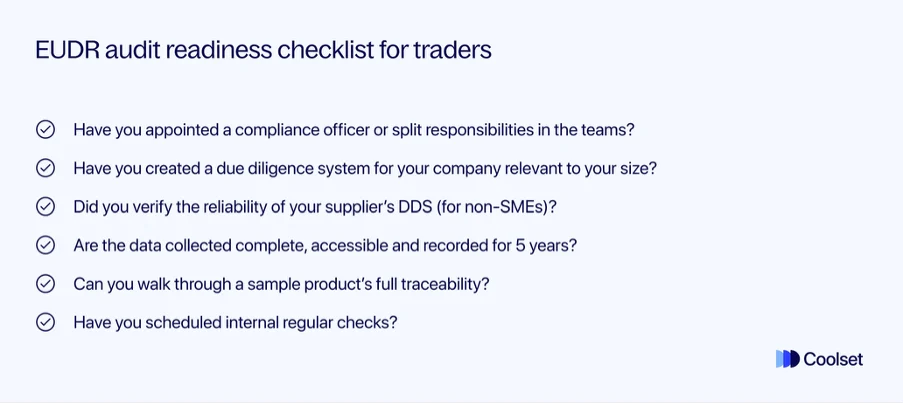

Hier zijn de belangrijkste acties die handelaren moeten ondernemen bij het voorbereiden van een EUDR-audit:

Begin met het maken van EUDR-compliance iemands taak of die van meerdere mensen. Wijs een algemene EUDR-leider of compliance-officier aan, maar zorg er ook voor dat je belangrijke teams betrekt waar relevant. Bijvoorbeeld de volgende teams spelen meestal een cruciale rol bij het implementeren van EUDR:

Gedeelde verantwoordelijkheid houdt compliance ingebed in je hele bedrijf, niet geïsoleerd in één team.

Ga er niet van uit dat compliance vanzelf gebeurt zonder enige veranderingen. Richt een intern due diligence-systeem op dat je verplichtingen weerspiegelt op basis van de bovenstaande stappen. Niet-MKB-handelaren moeten een gedocumenteerd due diligence-systeem hebben, inclusief gegevensverzameling, leveranciersbeoordeling, archivering en DDS-indieningen. MKB-handelaren hebben een duidelijk traceerbaarheidsproces nodig, zelfs zonder DDS in te dienen, je moet leverancierinformatie en DDS-referenties opslaan en deze op verzoek kunnen ophalen.

Auditors zullen zich doorgaans richten op vijf belangrijke gebieden. Ten eerste zullen ze je administratie controleren. Zijn je documenten compleet en toegankelijk? Ten tweede, als je een niet-MKB bent, zullen ze beoordelen hoe je hebt "vastgesteld" dat het DDS van je upstream leverancier geloofwaardig was. Ten derde zullen ze kijken of je due diligence-systeem (of traceerbaarheidssysteem, voor MKB's) daadwerkelijk aanwezig is en functioneert. Auditors kunnen ook een paar voorbeeldorders bekijken en je vragen om de compliance-reis van een product van eindverkoop tot oorsprong door te lopen.

Maak een centrale opslagplaats, of het nu een compliance-platform is, een ERP-functie of een gestructureerd mappensysteem waarin elk document duidelijk is gelabeld en gekoppeld aan het relevante product en de leverancier. Maak back-ups van alles en zorg ervoor dat alle records ten minste vijf jaar worden bewaard. Als iemand je team verlaat, moet je auditspoor nog steeds intact zijn.

Simuleer auditscenario's elk kwartaal of halfjaarlijks waarin je:

Deze droge runs kunnen vertrouwen opbouwen en zwakke punten aan het licht brengen voordat er een echte inspectie plaatsvindt.

Auditvoorbereiding is geen eenmalige inspanning. Als je zwakke punten identificeert tijdens interne beoordelingen, zoals inconsistente leveranciersgegevens of hiaten in bestandsopslag, los ze dan meteen op. Als je bedrijf groeit en de MKB-drempel nadert, begin dan met plannen om een volledig due diligence-systeem te implementeren. De beste tijd om je proces te versterken is voordat er een auditmelding binnenkomt.

Gebruik deze korte checklist om je EUDR-auditgereedheid te beoordelen en ervoor te zorgen dat er niets door de mazen van het net glipt.

Het laatste voorstel van de Europese Commissie (oktober 2025) omvat vereenvoudigde verplichtingen voor niet-MKB-handelaren - het verwijderen van de noodzaak voor hen om due diligence-verklaringen (DDS) in te dienen als upstream operators dit al hebben gedaan. Traceerbaarheids-, registratie- en gegevensuitwisselingsvereisten blijven echter bestaan. Deze wijzigingen zijn nog niet van kracht. Totdat ze formeel zijn aangenomen, moeten handelaren de huidige verplichtingen volgen zoals hieronder beschreven:

Handelaren zijn meer dan alleen tussenpersonen in de toeleveringsketen, ze zijn essentiële schakels om ervoor te zorgen dat EUDR-compliance van oorsprong tot eindmarkt wordt gehandhaafd. In veel gevallen passeren producten meerdere handelaren voordat ze hun eindbestemming bereiken. Dat betekent dat de verantwoordelijkheid om traceerbaarheid te behouden en door te geven vaak bij jou ligt.

De regelgeving maakt het duidelijk: elke actor moet zijn rol spelen om ontbossingsgerelateerde grondstoffen uit de EU-markt te houden. Voor handelaren betekent dit nu het opslaan en delen van de juiste gegevens, het doorgeven van DDS-referentienummers en het georganiseerd en toegankelijk houden van records voor audits.

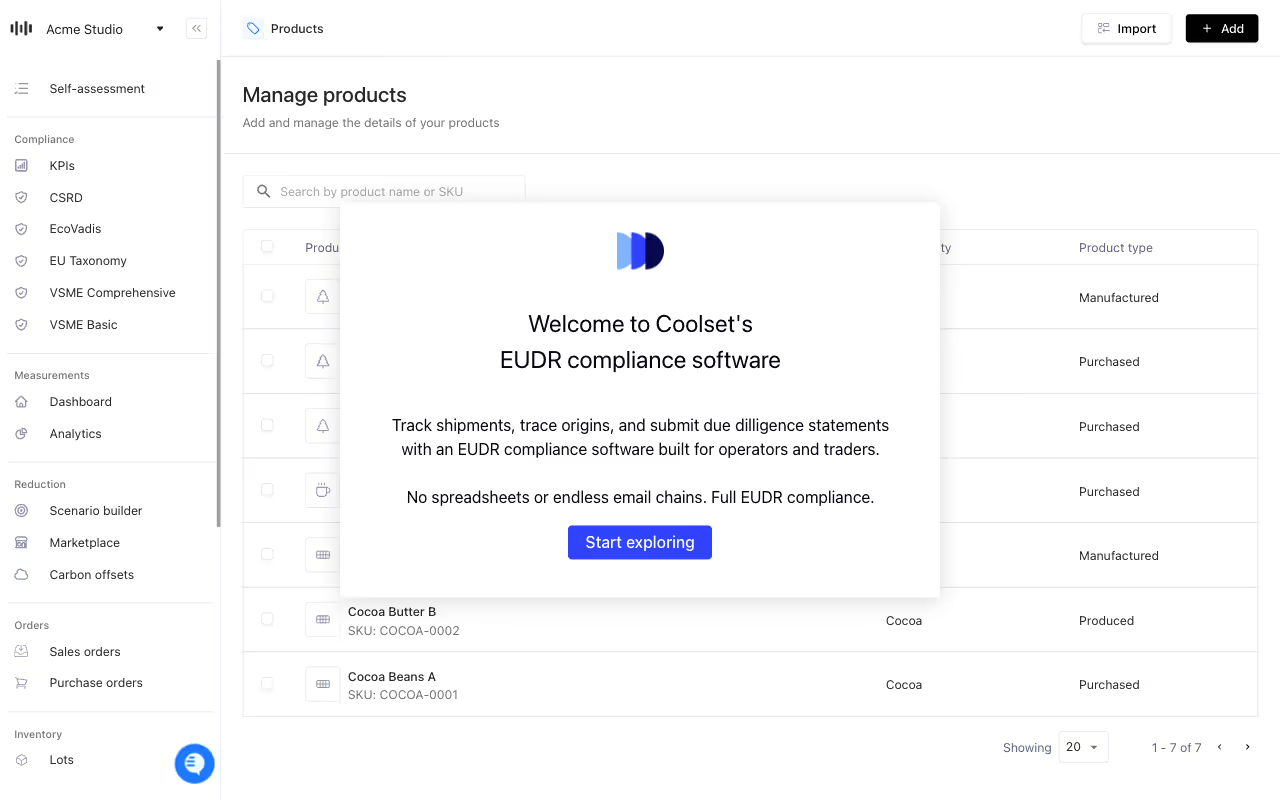

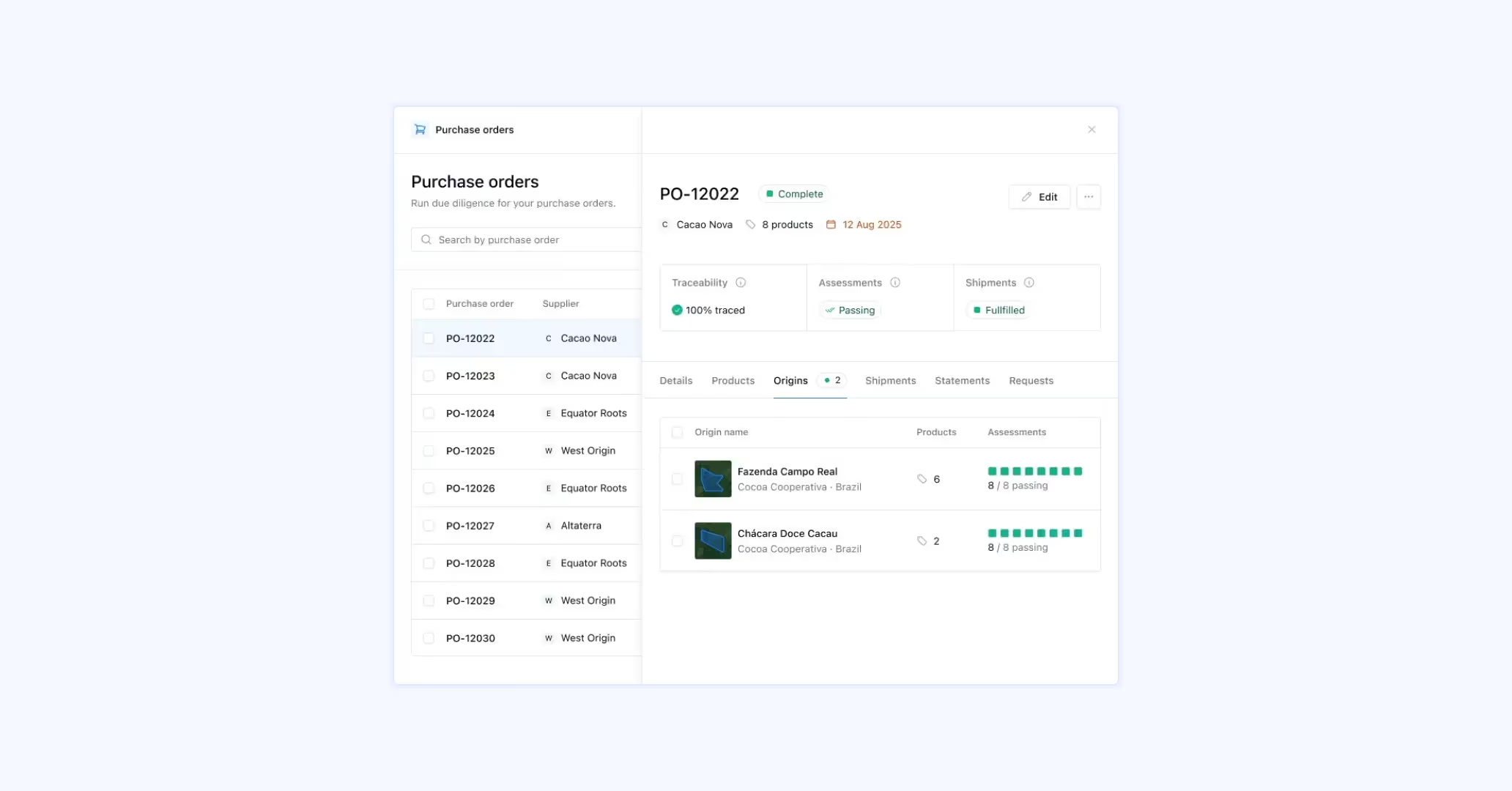

Hier kunnen digitale tools het verschil maken. Een goed ontworpen systeem kan je verzendgegevens verbinden met productdetails, leveranciers- en kopersinformatie en due diligence-records op één plek. Het vereenvoudigt hoe je compliance-documenten bijhoudt, opslaat en ophaalt. Het zorgt er ook voor dat je de juiste informatie downstream kunt verzenden of tijdens audits kunt presenteren zonder vertraging of verwarring.

Coolset's EUDR-module helpt handelaren en operators om traceerbaarheid efficiënt te beheren. Het centraliseert product-, leveranciers- en kopersgegevens, volgt DDS-referenties van upstream operators en onderhoudt complete, auditklare traceerbaarheidsrecords zonder afhankelijk te zijn van spreadsheets of e-mailketens. Het systeem markeert automatisch ontbrekende gegevens of documentatiehiaten en zorgt ervoor dat je op elk moment klaar bent voor regelgevende controles.

Neem contact op met ons team en zie Coolset EUDR-module in actie.

Get a practical introduction to the EUDR and its key requirements.

This free compliance checker scans your packaging documentation and maps it against mandatory PPWR data requirements, giving you a clear view of your compliance status. Get actionable insights on documentation gaps before they become compliance issues.

Track shipments, trace origins, and submit due dilligence statements with an EUDR compliance software built for operators and traders.

Based on customer case studies our team has developed a realistic timeline and planning for EUDR compliance. Access it here.