Disclaimer: New EUDR developments - December 2025

In November 2025, the European Parliament and Council backed key changes to the EU Deforestation Regulation (EUDR), including a 12‑month enforcement delay and simplified obligations based on company size and supply chain role.

Key changes proposed:

These updates are not yet legally binding. A final text will be confirmed through trilogue negotiations and formal publication in the EU’s Official Journal. Until then, the current EUDR regulation and deadlines remain in force.

We continue to monitor developments and will update all guidance as the final law is adopted.

The EU Deforestation Regulation (EUDR) is a new law aimed at fighting deforestation by ensuring that certain commodities and products are deforestation-free and legally produced. This means that any operator or trader placing regulated products on the EU market or exporting from it must be able to prove the products are not linked to recent deforestation.

Traders are currently expected to comply with the EUDR from December 30, 2025 for large and medium companies and June 30, 2026 for small and micro enterprises. However, The European Parliament recently voted for a series of adjustments to the EUDR which would delay enforcement to December 30, 2026 for large and medium operators and June 30, 2027 for small and micro enterprises.

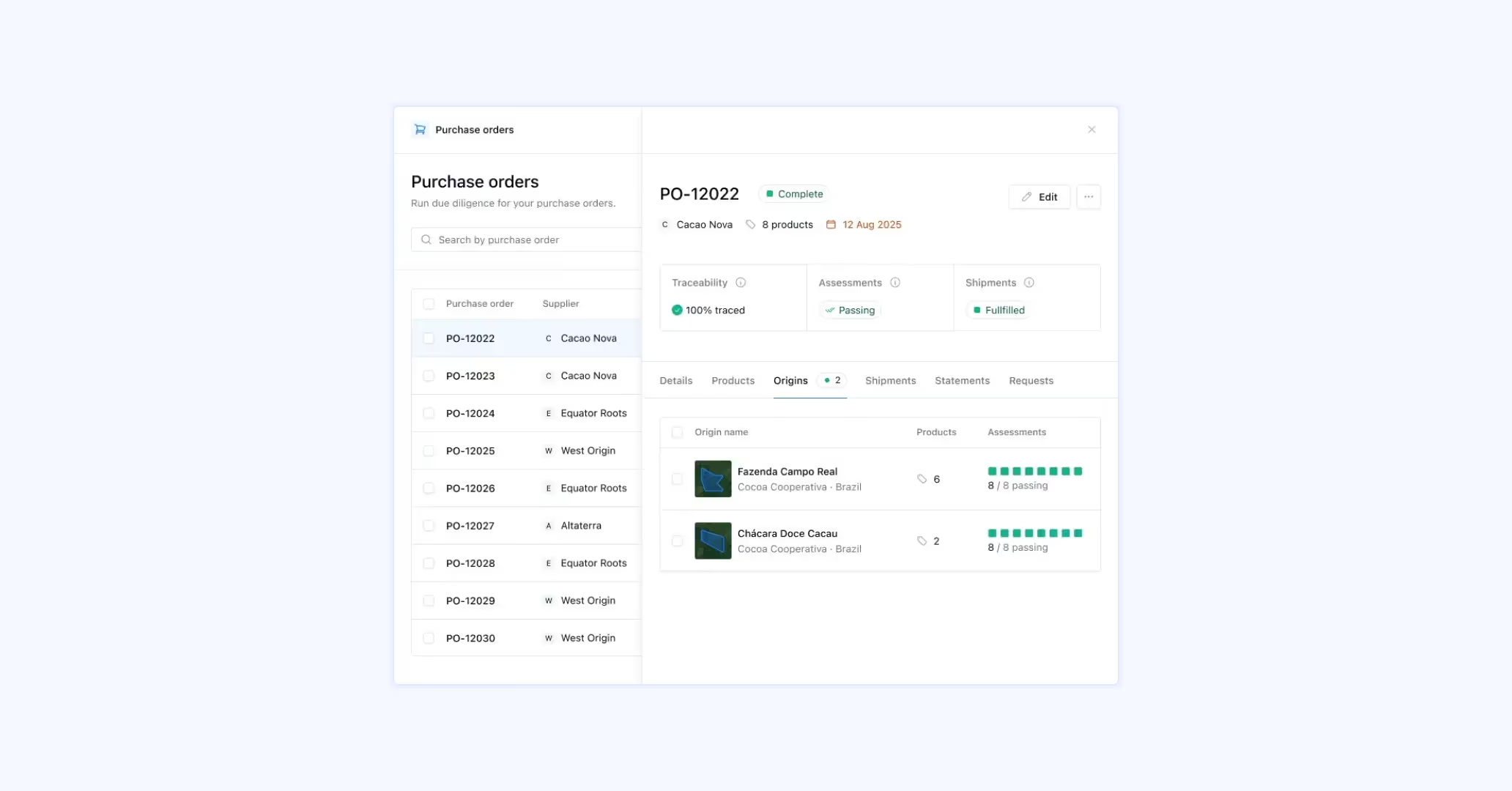

Traders play a crucial role in this system, bearing the responsibility to maintain and pass on traceability information across the supply chain. Their role is even more critical given how fragmented commodity markets are, often involving multiple layers of intermediaries before products reach the end market. In this guide, we break down what EUDR means for traders and outline practical steps from identifying your role to preparing for audits to help you meet the new requirements.

Under EUDR, a trader is defined as an SME or larger operator placing regulated products on the EU market for the first time. Any operator who buys or sells regulated products within the EU is considered a trader. This includes importers, distributors, wholesalers, and retailers. Even if you don't directly import products, if you are selling goods that have been produced with commodities covered by the EUDR, you are considered a trader and must comply with the regulation.

The key takeaway is that EUDR applies to a broad range of operators across the supply chain, not just importers. Understanding your role in the supply chain is critical to understanding your responsibilities under EUDR.

EUDR imposes several key responsibilities on traders:

Additionally, large operators (defined as those with net turnover exceeding EUR 150 million) are subject to stricter requirements under the EUDR, including regular audits and compliance certifications.

Traders can take the following steps to prepare for EUDR compliance:

By taking these proactive steps, traders can ensure they are well-prepared to meet the EUDR requirements and avoid potential penalties for non-compliance.

A practical 5-step playbook to prepare for EUDR

This free compliance checker scans your packaging documentation and maps it against mandatory PPWR data requirements, giving you a clear view of your compliance status. Get actionable insights on documentation gaps before they become compliance issues.

Our research team walks you through every step - from supplier engagement to submitting in TRACES.

Based on customer case studies our team has developed a realistic timeline and planning for EUDR compliance. Access it here.