Disclaimer: New EUDR developments - December 2025

In November 2025, the European Parliament and Council backed key changes to the EU Deforestation Regulation (EUDR), including a 12‑month enforcement delay and simplified obligations based on company size and supply chain role.

Key changes proposed:

These updates are not yet legally binding. A final text will be confirmed through trilogue negotiations and formal publication in the EU’s Official Journal. Until then, the current EUDR regulation and deadlines remain in force.

We continue to monitor developments and will update all guidance as the final law is adopted.

Disclaimer: 2026 Omnibus changes to CSRD and ESRS

In December 2025, the European Parliament approved the Omnibus I package, introducing changes to CSRD scope, timelines and related reporting requirements.

As a result, parts of this article may no longer fully reflect the latest regulatory position. We are currently reviewing and updating our CSRD and ESRS content to align with the new rules.

Key changes include:

We continue to monitor regulatory developments closely and will update this article as further guidance and implementation details are confirmed.

There’s no doubt that the EU’s Corporate Sustainability Reporting Directive (CSRD) has great potential to enhance corporate transparency and accountability across Europe. But as the saying goes, “nothing worth having comes easy.”

This new directive also comes with a highly complex set of requirements, a heavy reporting workload, and tight compliance deadlines. Companies in its scope must ensure they have the right systems and resources in place to tackle these new demands effectively.

While large organizations often have specialized teams and technology to comfortably handle these challenges, mid-market companies must typically manage with more limited resources. This can make CSRD compliance particularly daunting, often resulting in a more time-consuming, costly, and all-round stressful experience.

Many companies are turning to CSRD compliance software to take some of the burden off their shoulders. Specifically designed to streamline the reporting process, these tools minimize compliance risks and free up valuable resources so companies can focus on what matters most—growing their business.

This article will recap the essentials of the CSRD, explain why compliance is crucial for mid-market companies, and show you exactly how tools like Coolset can simplify and fast-track the compliance process.

The EU’s CSRD is a new climate regulation that requires companies to provide detailed reports on their environmental and social impact. Here are some key facts mid-market companies should be aware of:

The CSRD was specifically designed for companies based within the European Union. It also extends to non-EU companies that have significant operations or listings in Europe.

The directive applies to companies across all economic sectors, whether that’s finance, manufacturing, energy, technology, or transportation. It also covers large public interest entities like banks and insurance companies due to their broad social and economic impacts.

The initial phase of CSRD implementation during 2024 and 2025 focuses on large publicly listed companies only. Starting in 2026, certain provisions will apply to listed mid-market companies followed by third-country undertakings in 2028 (more on the timeline soon).

For mid-market companies, this widened scope means they should start preparing for CSRD compliance as early as possible to ensure they are ready when their turn comes.

The European Commission is also developing tailored standards that non-listed mid-market companies can use voluntarily. This will make it easier for mid-market companies to report important sustainability information and boost attractiveness to customers, investors, and financial institutions who value sustainability.

{{custom-cta}}

Failure to comply with the CSRD can result in significant financial and legal repercussions. It’s up to individual Member States to determine and enforce specific penalties. Generally speaking, penalties should be effective, proportionate, and dissuasive enough to ensure companies stick to the requirements.

While the exact penalties for non-compliance are yet to be quantified, they should become clearer as the directive rolls out. It’s thought that penalties will be similar to those under the previous NFRD.

Under the NFRD, 27 countries had some form of penalty in the case of non-compliance. On the lower end, fines in Portugal ranged from €50 to €1,500. More severe penalties included fines up to €375,000 and imprisonment for up to 5 years in France, and imprisonment for up to six months in Ireland for non-compliance.

Germany had some of the highest penalties, up to €10 million, or 5% of a company's global annual turnover, or twice the profits gained or losses avoided due to non-compliance.

For mid-market companies, the implications of CSRD non-compliance extend beyond legal sanctions. ESG performance is increasingly important for investors, with ESG considered by 89% of investors when making investment decisions. Similarly, 83% of consumers believe companies should be actively shaping their ESG best practices.

Failing to comply can, therefore, severely damage your company's reputation, erode consumer trust, and deter corporate partnerships. It can also lead to reduced investment and a loss of business opportunities with clients and partners who prioritize sustainability.

These consequences really stress the importance of compliance to sustain business growth and investor relations.

The CSRD will be phased in gradually depending on company size, revenue, and location. Here are the key dates to be aware of:

Here’s a closer look at the key challenges mid-market companies face in CSRD compliance:

The CSRD is a complex directive made up of 12 standards and 82 reporting requirements. This translates to around 500 KPIs and over 10,000 data points that need to be meticulously tracked and reported.

According to Workiva’s 2024 ESG Practitioner Survey, 83% of companies anticipate difficulties in collecting accurate data for CSRD reporting. For mid-market companies, the sheer volume and complexity of these requirements can be understandingly overwhelming, especially on top of other operational responsibilities.

The high complexity of the CSRD brings with it an intense workload. In fact, one sustainability expert estimated it would take around 375 hours just to gather the necessary data to fulfill the first set of ESRS. This considerable time investment can strain already limited resources within mid-market companies.

Implementing CSRD compliance may require mid-market companies to build or expand their sustainability teams. This means hiring professionals with specialized knowledge in sustainability reporting and compliance—a significant financial investment for companies working with constrained budgets.

The timeline for CSRD compliance is tight. Mid-market companies that fall within scope must comply with the CSRD in 2026, reporting in the 2027 financial year. While this deadline may seem like a while away, achieving compliance takes time. This makes it crucial to start the process well ahead of the deadline to ensure readiness and avoid penalties.

It’s important to highlight that the ESRS are still under development. The second set, expected to offer more practical and proportionate guidelines for mid-market companies, is anticipated around mid-2026. This means mid-market companies must remain agile and be ready to adapt quickly to the finalized standards once they are published.

Recent studies highlight the growing reliance on external support and technology for CSRD compliance. According to a 2023 PwC study, 58% of companies count on external support for implementing the CSRD. Similarly, Workiva's 2024 survey found that 89% of companies plan to allocate budget towards technology for ESG initiatives within the next three years.

For mid-market companies, the challenge of complying with the CSRD can be particularly daunting. Using the right software, like Coolset's CSRD compliance module, can make all the difference.

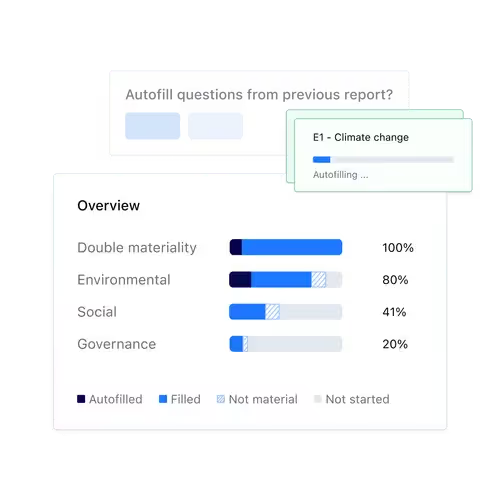

Coolset simplifies the entire process from data collection to reporting and auditing, making it easier to tackle the directive's complex requirements. Built alongside regulators and auditors, our CSRD compliance suite offers tons of useful features for mid-market companies including:

Start simplifying your CSRD compliance journey by scheduling a free demo with a Coolset climate expert today.

Download our collection of sustainability e-books.

Speak to one of our experts to find out more about what CSRD is all about, and how we can help you produce audit-proof sustainability reports.

Based on customer case studies our team has developed a realistic timeline and planning for EUDR compliance. Access it here.