Disclaimer: New EUDR developments - December 2025

In November 2025, the European Parliament and Council backed key changes to the EU Deforestation Regulation (EUDR), including a 12‑month enforcement delay and simplified obligations based on company size and supply chain role.

Key changes proposed:

These updates are not yet legally binding. A final text will be confirmed through trilogue negotiations and formal publication in the EU’s Official Journal. Until then, the current EUDR regulation and deadlines remain in force.

We continue to monitor developments and will update all guidance as the final law is adopted.

Disclaimer: 2026 Omnibus changes to CSRD and ESRS

In December 2025, the European Parliament approved the Omnibus I package, introducing changes to CSRD scope, timelines and related reporting requirements.

As a result, parts of this article may no longer fully reflect the latest regulatory position. We are currently reviewing and updating our CSRD and ESRS content to align with the new rules.

Key changes include:

We continue to monitor regulatory developments closely and will update this article as further guidance and implementation details are confirmed.

ESG reporting has entered a new phase. The Omnibus I package, approved by the European Parliament in December 2025, significantly narrowed the scope of the Corporate Sustainability Reporting Directive (CSRD) — now limited to companies with more than 1,000 employees and turnover exceeding €450 million. Wave 2 and 3 reporting timelines have been pushed to 2028 and 2029 respectively, and the European Sustainability Reporting Standards (ESRS) datapoints have been reduced from over 1,100 to an estimated 400–500, pending a delegated act expected mid-2026.

For many companies, this means more breathing room. But for those still in scope, the obligations remain complex - and the Omnibus changes don't make preparation optional. First reporting under the revised rules starts January 2027. That gives in-scope enterprises roughly a year to get their data infrastructure, materiality assessments and supplier engagement processes in order. For a full breakdown of who is still in scope after Omnibus, see our dedicated article.

There's also an important nuance: companies above the CSRD threshold are almost always managing other overlapping ESG obligations at the same time - EU Taxonomy, GRI, CDP, EcoVadis. A tool that handles CSRD in isolation won't solve the broader challenge.

For a deeper look at how the Omnibus changes affect software selection specifically, see our CSRD software buyer's guide.

This article compares 15 of the leading ESG reporting tools available today - what they do, who they're built for, and what to look for when making your decision.

ESG reporting focuses on disclosing specific data points to assess a company's environmental, social, and governance risks and performance. Primarily investor-focused, it includes sustainability measures as well as metrics related to gender equality, employee benefits, greenwashing, and more.

Sustainability reporting is broader and focuses on environmental, social, and economic impacts. It's often used as a communication tool by businesses to show progress toward sustainable development goals — measuring things like carbon emissions, energy and water consumption.

When done manually, ESG data collection and reporting is time-consuming, error-prone, and hard to scale. Without oversight, it increases the risk of non-compliance and makes strategic decision-making harder due to inconsistent or incomplete data.

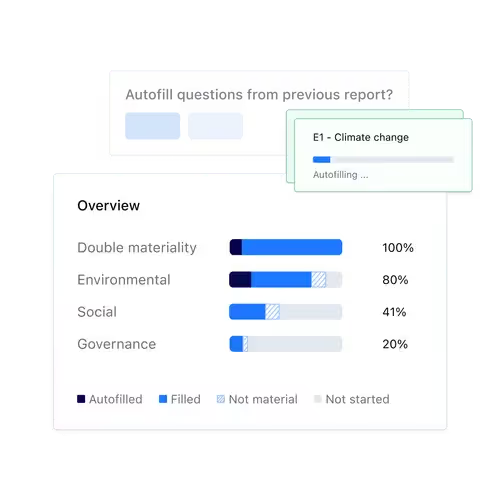

ESG reporting software eliminates these inefficiencies by centralizing all data, automating repetitive tasks, and ensuring traceability across reporting cycles. The best platforms now use AI to extract, validate and prefill ESG data — and increasingly allow data collected for one framework to be reused across others, eliminating duplication when managing CSRD, EU Taxonomy and EcoVadis simultaneously.

Key benefits include:

Coolset is an ESG and supply chain compliance platform built for teams managing multiple regulatory obligations at once. It covers CSRD, EU Taxonomy, VSME, EcoVadis, EUDR and EUTR in one platform - and keeps each module updated as regulations change, so teams are never working with outdated requirements.

Guided, step-by-step workflows break down complex regulatory requirements into clear tasks, making it possible for any team member to contribute to audit-ready reports without deep regulatory expertise. Data collected for one framework can be reused across others, eliminating duplicate entry when managing overlapping obligations. AI-powered autofills, smart suggestions and linked supporting evidence keep disclosures accurate and traceable.

Best for: Compliance-first teams in mid-market and larger companies (500–5,000 employees) managing multiple ESG frameworks

Features: Guided regulatory workflows, AI autofills and suggested answers, cross-framework data reuse, linked supporting evidence, scope 1–3 emissions tracking, audit-ready reporting, always up-to-date frameworks

Pricing: Available on request

Website: www.coolset.com

Workday is a cloud-based software provider that develops applications to help businesses manage payroll, benefits, HR, and employee data. Its data and analytics platform helps businesses stay on track with ESG initiatives and reporting by delivering sustainability insights to decision-makers.

Best for: Medium to large businesses already on the Workday ecosystem

Features: Social reporting for ESG, supplier risk and sustainability tracking, streamlined workforce reporting

Pricing: Included at no additional cost for existing Workday customers

Website: workday.com

Diligent's ESG reporting platform centralizes governance, risk, compliance, and ESG management. It makes it easier to monitor, measure, and report on ESG matters across an organization.

Best for: Organizations looking for comprehensive GRC and ESG management

Features: Board, risk, audit and ESG reports, benchmarking and insights, centralized GRC and ESG platform

Pricing: Custom pricing on request

Website: diligent.com

Workiva unifies financial reporting, ESG reporting, and audit and risk management into one platform. With pre-built ESG frameworks to choose from, businesses can report against the standards relevant to them.

Best for: Companies looking for a combined ESG, GRC and financial reporting platform

Features: End-to-end ESG reporting, cross-team collaboration, pre-built ESG frameworks, materiality assessment template

Pricing: Custom pricing based on business needs

Website: workiva.com

Sweep is a carbon and ESG data platform that helps businesses collect, manage, and report ESG data across a range of industries and standards.

Best for: Businesses of all sizes looking to streamline carbon and ESG data collection

Features: Simplified ESG data collection and reporting, compliance with major ESG standards, customizable surveys, corporate emissions and supply chain tracking

Pricing: Custom pricing based on specific business needs

Website: sweep.net

Persefoni is an AI-powered climate management and carbon accounting platform. It helps businesses measure their carbon footprint, develop decarbonization plans, and comply with emissions reporting requirements including CSRD and SEC disclosure rules.

Best for: Businesses and financial services focused on carbon accounting and climate management

Features: AI-powered carbon measurement and reporting, regulatory and investor emissions reporting, decarbonization management, Scope 3 supplier engagement

Pricing: PRO, PRO+ and ADVANCED plans, available on request

Website: persefoni.com

Cority's sustainability and ESG solution helps businesses measure and report ESG performance. The platform focuses on accuracy, auditability, and centralized data management.

Best for: Organizations seeking sustainability and ESG data management solutions

Features: Sustainability Cloud for auditable ESG data, centralized management, streamlined reporting

Pricing: Custom pricing based on specific needs

Website: cority.com

Benchmark Gensuite's ESG reporting and management software is designed for enterprise leaders who need investor-grade ESG data and insights. It includes four sustainability tools covering emissions tracking, resource utilization, reduction planning, and ESG prioritization.

Best for: Enterprise leaders

Features: Desktop and mobile analytics, collaborative dashboards, data mining and reporting, multi-application data compilation

Pricing: Available on request; demo offered

Website: benchmarkgensuite.com

LucaNet is an end-to-end ESG solution that collects and analyzes sustainability data and produces compliant reports. It integrates with over 300 data sources for automated data collection.

Best for: Companies integrating ESG with financial reporting

Features: 300+ interfaces for data automation, central ESG data management, EU Taxonomy compliance

Pricing: Available on request

Website: lucanet.com

Greenly is a carbon accounting platform that helps businesses assess, manage, and reduce CO2 emissions. It supports greenhouse gas measurement, decarbonization planning, carbon offsetting and progress reporting.

Best for: Companies of all sizes focused on carbon emissions reduction

Features: Carbon footprint analysis, decarbonization strategies, sustainable procurement tools

Pricing: Available on request

Website: greenly.earth

IBM's Envizi ESG Suite is a cloud-based platform that helps enterprises capture and manage ESG data in a single system, with templates for reporting against multiple frameworks including CSRD.

Best for: Large enterprises consolidating ESG data management

Features: Robust ESG data and GHG calculations, streamlined compliance reporting, decarbonization analytics

Pricing: Starting at approximately €4,162/month

Website: ibm.com/products/envizi

AuditBoard's ESG and sustainability management platform centralizes ESG programs into a single system, with a focus on audit, risk and compliance teams.

Best for: Audit, risk and compliance teams across industries

Features: Centralized ESG data and evidence collection, simplified reporting and disclosures, ESG integrated into enterprise risk management

Pricing: Available on request via demo

Website: auditboard.com

Novisto is an ESG data management and analytics platform that automates workflows to accelerate sustainability reporting. It includes AI-powered tools for data quality and insights.

Best for: Companies looking to streamline ESG data management and reporting workflows

Features: Automated ESG reporting workflows, centralized audit-ready data, AI-assisted data quality

Pricing: Available on direct request

Website: novisto.com

SustainIQ helps businesses measure, monitor, and report sustainability and ESG data in real-time, covering areas like waste management, social value and biodiversity.

Best for: Businesses centralizing sustainability and ESG data for holistic reporting

Features: Real-time ESG reporting, automation and manual data capture, bulk upload functionality

Pricing: Available on request via demo

Website: sustainiq.com

KeyESG is an all-in-one ESG management platform covering data collection, emissions calculation, analysis and reporting in line with global standards.

Best for: Businesses seeking efficient end-to-end ESG management

Features: Simplified data collection, major ESG framework compliance, intelligent reporting, target setting

Pricing: Available on request via demo

Website: keyesg.com

The Omnibus changes have shifted the buying context. If your company is still in scope for CSRD, you're almost certainly managing other overlapping obligations - EU Taxonomy, EcoVadis, GRI, Scope 3 supplier data. A CSRD-only tool creates silos; what you need is a platform built for that overlap. For a full breakdown of evaluation criteria and red flags, see our CSRD software buyer's guide.

When evaluating tools, focus on:

Regulatory coverage and adaptability. The EU regulatory environment is moving fast. Look for a platform that has demonstrably kept pace - updated its CSRD module post-Omnibus, reflects current ESRS datapoints, and has a clear approach to staying current as final guidance lands in mid-2026. Our CSRD reporting guide has more on what good preparation looks like.

Cross-framework data reuse. If you're managing CSRD, EU Taxonomy and EcoVadis simultaneously, you should be entering data once and reusing it across frameworks - not re-entering it three times. Check whether your shortlisted platforms support this in practice.

Scope 1–3 emissions coverage. Understanding your full emissions footprint - including supply chain - is a prerequisite for CSRD, EcoVadis and setting credible decarbonization targets. Confirm the platform covers all three scopes with the granularity your reporting requires.

Audit-readiness. Every data point, disclosure and report should be traceable to its source - whether that's a policy document, supplier declaration or uploaded file. This isn't just good practice; it's what auditors will expect. See our article on CSRD reporting best practices for a deeper look at what audit-ready reporting requires.

Ease of use. Complex regulations don't need to produce complex software. The best platforms translate dense regulatory requirements into guided, step-by-step workflows that any team member can follow - not just sustainability specialists. If a demo requires heavy onboarding before anything makes sense, that's a signal.

VSME readiness. Companies that fall outside the revised CSRD thresholds may still need to report - whether voluntarily or because clients and investors request it. A platform that supports VSME alongside CSRD gives you more flexibility as the landscape continues to evolve.

There are plenty of ESG reporting tools available, each with a different focus and depth of coverage. The right choice depends on which frameworks apply to you, how many you're managing simultaneously, and how much regulatory change you expect to navigate in the next 12–18 months. If you're specifically evaluating CSRD-focused tools, our top CSRD software tools article goes deeper on that shortlist.

At Coolset, we help compliance-first teams manage ESG, carbon and supply chain reporting in one platform - with guided workflows, automated data collection and always up-to-date frameworks. Schedule a free demo with an ESG expert to see how it works in practice.

Try Coolset's ESG reporting software

Try Coolset's ESG reporting software

Based on customer case studies our team has developed a realistic timeline and planning for EUDR compliance. Access it here.