Disclaimer: New EUDR developments - December 2025

In November 2025, the European Parliament and Council backed key changes to the EU Deforestation Regulation (EUDR), including a 12‑month enforcement delay and simplified obligations based on company size and supply chain role.

Key changes proposed:

These updates are not yet legally binding. A final text will be confirmed through trilogue negotiations and formal publication in the EU’s Official Journal. Until then, the current EUDR regulation and deadlines remain in force.

We continue to monitor developments and will update all guidance as the final law is adopted.

Disclaimer: 2026 Omnibus changes to CSRD and ESRS

In December 2025, the European Parliament approved the Omnibus I package, introducing changes to CSRD scope, timelines and related reporting requirements.

As a result, parts of this article may no longer fully reflect the latest regulatory position. We are currently reviewing and updating our CSRD and ESRS content to align with the new rules.

Key changes include:

We continue to monitor regulatory developments closely and will update this article as further guidance and implementation details are confirmed.

Navigating EU sustainability regulations can be confusing - especially when you're unsure which rules actually apply to your business. With the Corporate Sustainability Reporting Directive (CSRD) now live, and additional frameworks like EUDR and CBAM,gaining traction, many mid-sized companies are asking a simple question: what do we actually need to comply with?

If you're looking for a direct answer, skip the guesswork and use Coolset's ESG legislation checker. In 2–4 minutes, you’ll get a personalized overview of which ESG frameworks apply to your business based on your size, structure, and operations.

This article helps you understand what each framework covers - and why they’re increasingly relevant if your company operates in the EU or has subsidiaries or supply chain links there.

Sustainability regulation in the EU is expanding rapidly. What used to be voluntary guidelines are becoming mandatory obligations.

However, figuring out which ESG reporting frameworks actually apply depends on multiple factors:

For many businesses - particularly mid-market companies - it's not immediately clear which directives apply or when. That’s where automated support becomes valuable.

Here’s a quick breakdown of the six key frameworks that Coolset’s ESG tool currently checks for:

Mandatory for large EU companies and, increasingly, non-EU companies with significant EU operations. Applies to firms meeting two of the following: >250 employees, >€40M turnover, >€20M balance sheet total. Requires reporting in line with the European Sustainability Reporting Standards (ESRS).

Applies to EU importers of carbon-intensive goods like steel, cement, aluminum, fertilizers, and hydrogen. Companies must report embedded emissions and purchase certificates to match the carbon price had the goods been produced in the EU.

Targets companies placing products on the EU market that are associated with deforestation (e.g., soy, palm oil, coffee, cocoa, rubber, beef, wood). Businesses must demonstrate deforestation-free sourcing via due diligence.

A proposed directive that will require large companies to identify and mitigate human rights and environmental impacts in their own operations and across their value chains. Will affect both EU and non-EU companies operating in Europe.

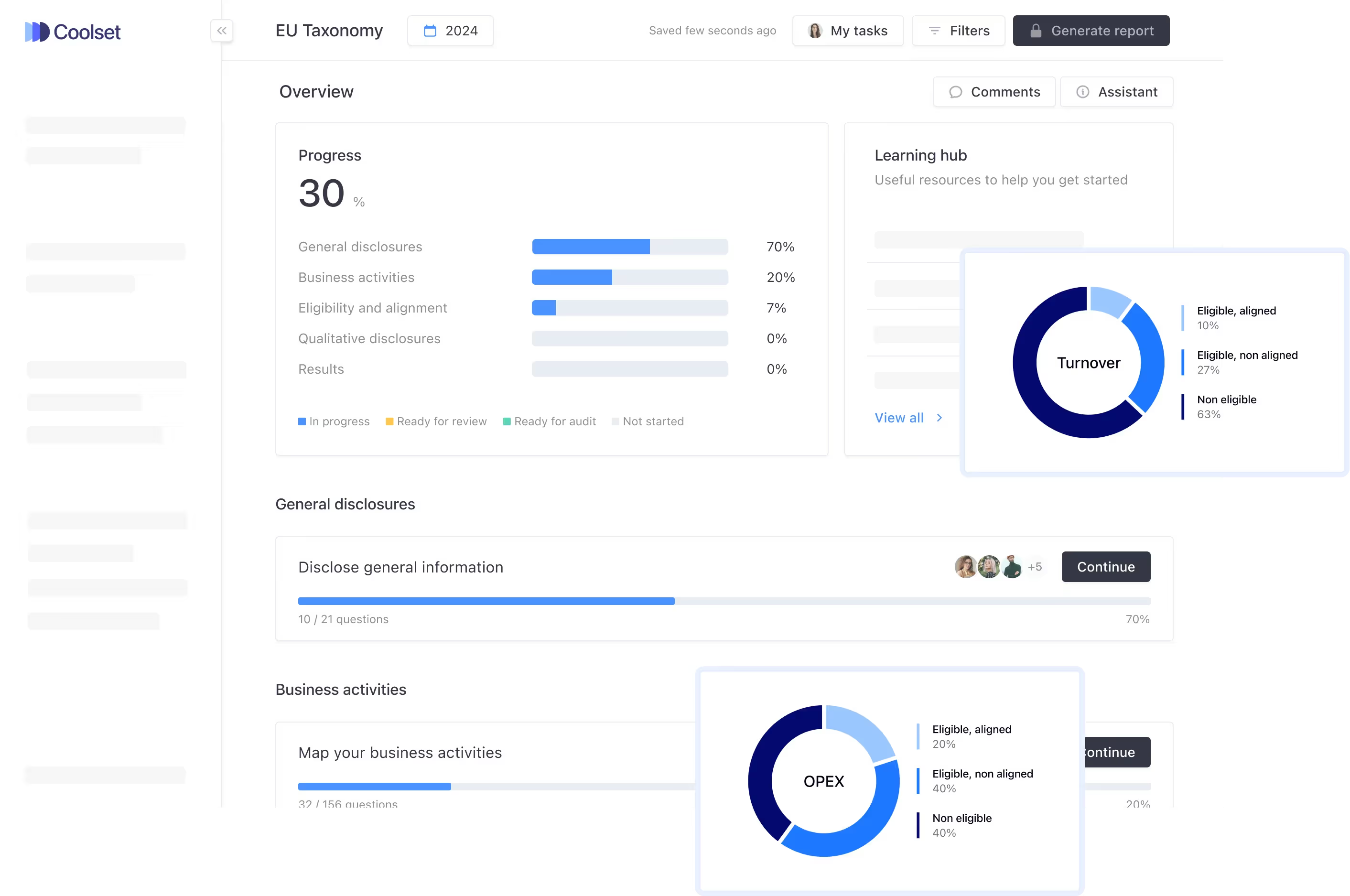

Defines which economic activities can be considered environmentally sustainable. Not a reporting directive on its own, but embedded into CSRD and used to assess alignment of business activities with climate goals.

Applies to financial market participants (like asset managers and investment funds). Requires ESG risk disclosures at both the entity and product level. Often relevant for private equity or large corporates with investment arms.

Each framework comes with its own thresholds and criteria - which means the only reliable way to assess your obligations is by mapping them to your company’s structure, activities, and value chain.

That’s why we built the Coolset ESG framework tool. It’s a short, guided questionnaire that:

It only takes a few minutes to complete. No legal jargon or policy deep-dives required.

If you’re unsure where to start with ESG compliance - or want to validate that you’re focused on the right frameworks - use the tool to check your position. It’s free, fast, and designed to help mid-market enterprises stay ahead of sustainability reporting obligations.

For more detailed reading sustainability regulations, explore our Academy.

Comply with ESG frameworks such as CSRD, EUDR, CBAM or EU Taxonomy easily from one place in the Coolset platform.