Disclaimer: New EUDR developments - December 2025

In November 2025, the European Parliament and Council backed key changes to the EU Deforestation Regulation (EUDR), including a 12‑month enforcement delay and simplified obligations based on company size and supply chain role.

Key changes proposed:

These updates are not yet legally binding. A final text will be confirmed through trilogue negotiations and formal publication in the EU’s Official Journal. Until then, the current EUDR regulation and deadlines remain in force.

We continue to monitor developments and will update all guidance as the final law is adopted.

Under the EU Deforestation Regulation (EUDR), companies are required to conduct mandatory due diligence before placing regulated commodities on the EU market or exporting them from it.

The aim is clear: ensure that products are deforestation-free, legally produced, and properly documented.

Article 3 of the regulation sets the core requirements, which in practice means businesses must demonstrate three things:

Meeting these requirements demands more than a checkbox approach. Companies need a structured due diligence system that traces products to origin, assesses and mitigates risks, and creates a clear audit trail.

This article outlines what due diligence entails under the EUDR, what companies must prove, what data is needed for the DDS, and how to maintain a compliant, auditable process.

{{custom-cta}}

Article 8 of the regulation outlines a three-step framework that all operators must follow:

a) the collection of information, data and documents needed to fulfil the requirements set out in Article 9

b) risk assessment measures as referred to in Article 10

c) risk mitigation measures as referred to in Article 11

These steps must be completed before placing any in-scope products on the EU market or exporting them from it.

Here's how the process works in practice:

Companies must gather verifiable data about the product and its supply chain. Article 9 of the EUDR outlines the specific information requirements that must be collected for each product before any commercial action such as placing goods on the market or exporting can take place.

Several key data points are required, including basic shipment information, production date, geolocations of plots of harvest and more.

The final two requirements are especially critical: operators must provide adequately conclusive and verifiable evidence that the product is both deforestation-free and legally produced. The regulation itself does not give an explicit definition of what this term means and it is up to the person reviewing the information to make sure they meet the standards of the term. However, considering the technical terminology used a reasonable interpretation is that the data must be strong enough to remove reasonable doubt, and documented in a way that allows authorities to independently confirm its accuracy.

Once data is collected, companies must assess whether the product carries any risk of being non-compliant either due to links with deforestation or illegality in the country of origin. The bar is high: only products assessed as “negligible risk” can be placed on the market.

Risk factors may include indicators like deforestation rates in the country of origin, the presence of indigenous land claims, corruption or law enforcement issues, supply chain complexity, and more.

These risk categories are outlined in Article 10 of the regulation, but they are not exhaustive. Companies are expected to develop their own risk assessment procedures based on the specific characteristics of their supply chains, and to adapt them as new information becomes available.

Where risks are identified, companies must take appropriate measures to reduce them to a negligible level. As outlined in Article 11 of the regulation, mitigation is not a one-size-fits-all checklist; it must be tailored to the nature and severity of the risk identified during assessment.

This is a dynamic process that may involve multiple iterations. In most cases, companies should start by requesting further clarification or documentation from suppliers. If the information provided remains insufficient, more steps such as field audits, satellite monitoring, or switching to alternative sources may be necessary.

A product can only proceed to the DDS submission once the operator can reasonably conclude that the risk is negligible and properly substantiated.

After completing the steps of information collection, risk assessment, and (if needed) mitigation, the operator must finalize and submit a Due Diligence Statement (DDS). This is a formal declaration confirming that due diligence has been properly carried out and that the product complies with the EUDR’s deforestation-free and legality requirements. Operators don’t need to submit a long document listing every data point though. Instead, they upload a declaration through the EU system and must keep the underlying due diligence information on file in case authorities request it.

Based on the regulation, a DDS must be submitted before the commercial activity takes place, meaning before the product is placed on the EU market or exported. In practice, this means you should complete the process before goods are shipped. For imports, the product cannot clear customs without a valid DDS.

In November 2025, the European Parliament voted in favor of simplifying EUDR due diligence obligations based on a company’s size and role in the supply chain. These changes aim to reduce administrative burden while maintaining traceability and legal accountability.

Here’s how responsibilities change under the updated framework:

These changes are designed to concentrate compliance where deforestation risk is most directly controllable, at the point of placing goods on the market. Until formally adopted, however, companies should continue following the current legal framework.

Collecting the right data is the foundation of a compliant due diligence system. You can’t assess risks or submit a DDS without first documenting the required information.

According to Article 9 of the EUDR, the data requirements fall into five practical categories:

This covers the core product and transaction data needed to describe the goods and trace their movement.

What to collect:

How to collect it:

Most of this data is already captured in commercial invoices, packing lists, ERP systems, or logistics documentation. Procurement and operations teams typically manage this.

Traceability to the exact origin is a core EUDR requirement. Every commodity must be linked to the plot(s) where it was produced.

What to collect:

How to collect it:

Request coordinates or GeoJSON files directly from suppliers. Platforms like Coolset provide built-in tools to make this easier which is especially useful when producers don’t have technical mapping capabilities.

Companies must prove that commodities did not come from land deforested or degraded after 31 December 2020.

What to collect:

How to collect it:

Use deforestation screening tools, remote sensing platforms, or integrated features in software like Coolset. Evidence must be tied to production coordinates and clearly timestamped.

Pro tip: Use verifiable satellite imagery with timestamps. Avoid generic images or unverified supplier statements.

Products must comply with all applicable laws in the country of origin including environmental, labor, and land rights regulations.

What to collect:

How to collect it:

Request official records from suppliers or local authorities. Certification platforms or third-party consultants may assist in verifying legal compliance.

Pro tip: Collect official documents with traceable reference numbers. Don’t rely on informal or handwritten declarations.

Beyond the DDS, companies must evaluate contextual risks as part of their Article 10 obligations.

What to collect:

How to collect it:

Use public databases, supplier questionnaires, or third-party analysis. These insights feed into your risk assessment and determine whether mitigation is needed.

The process of creating a risk assessment methodology, collecting all the data and assessing the risks can be a very demanding process. EUDR solutions like Coolset offer a built in methodology that incorporates all these data sources into a cohesive risk assessment.

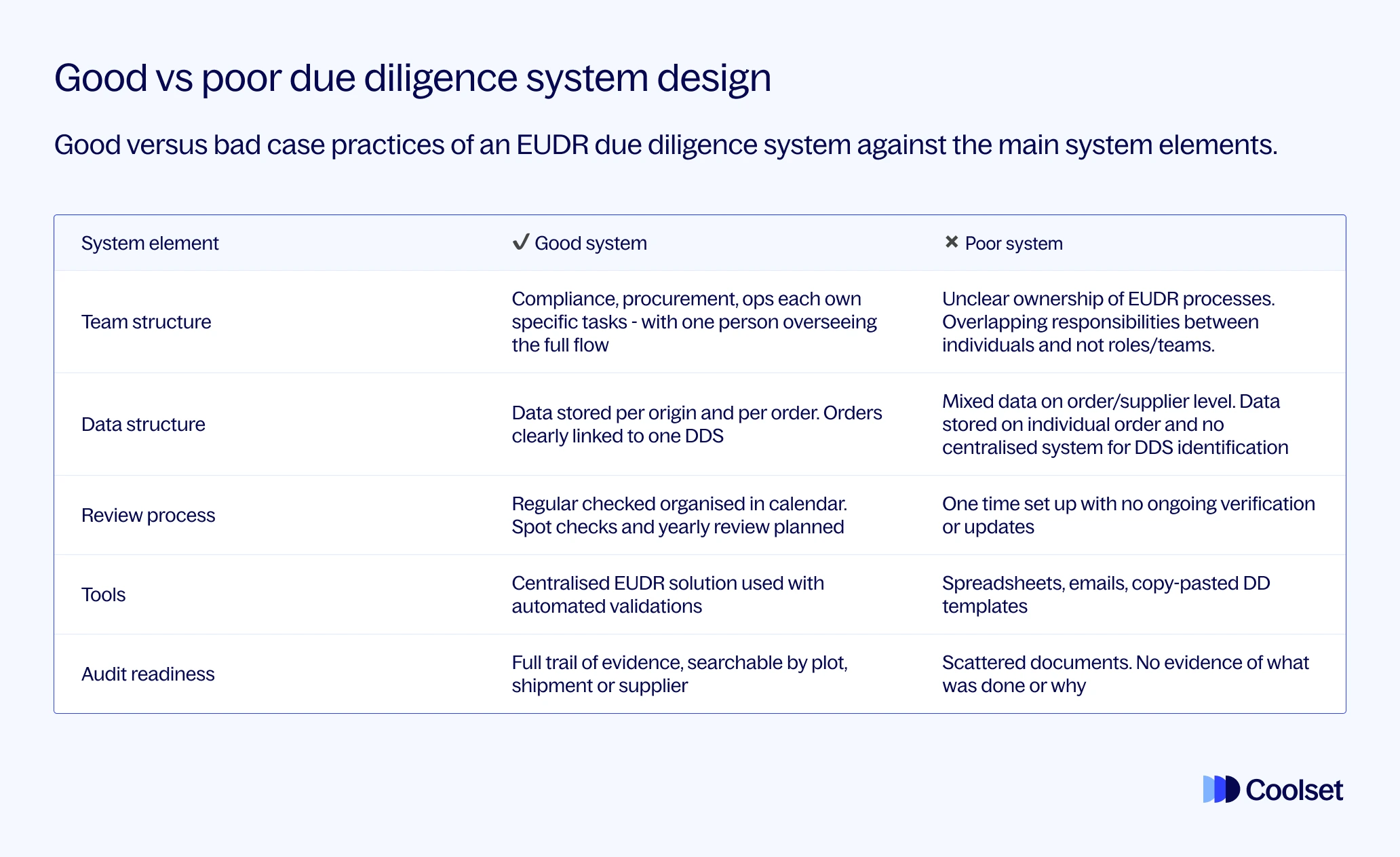

EUDR compliance isn’t a checklist. It’s a repeatable, auditable system. A defensible due diligence system must include clear workflows, assigned responsibilities, structured data management, and continuous oversight to ensure every requirement is met.

Building and maintaining an effective due diligence system requires collaboration across three core functions:

To make this work in practice, companies should appoint a named due diligence coordinator.

A strong due diligence system also depends on how information is stored and structured. We propose dividing records into two categories:

This includes documents that relate to the production plot or producer and remain valid over time until something changes:

Once verified, this information can be reused across multiple DDS submissions, as long as the underlying conditions remain unchanged.

These records are unique to each order or shipment and must be updated with every transaction:

A defensible system also means keeping your process quality-controlled. While the EUDR requires at least one full system review per year, proactive companies build in regular check-ins to catch issues early and improve system maturity over time.

Monthly spot checks

Quarterly coordination reviews

Annual system audit

Achieving EUDR compliance is complex, and even well-intentioned companies can fall into traps that put them at risk of non-compliance. Below are some of the most common issues and how to address them before they escalate into enforcement problems.

One of the most frequent mistakes can be using incorrect plot coordinates. Suppliers may provide GPS points for a warehouse or vague polygons that exclude recently deforested areas.

How to avoid it:

Always validate coordinates using mapping tools or satellite imagery. Ensure production dates are clearly tied to the geolocation data and that the provided coordinates match an agricultural/forest area. Opt for some standardised guidance to be given to suppliers on what is expected from them.

2. Over-relying on certifications

Certifications like FSC or RSPO can support your assessment but do not replace due diligence. Many don’t align fully with EUDR criteria especially regarding cutoff dates or legal scope.

How to avoid it:

Use certifications as supporting evidence only. Independently verify that the certificate’s coverage, timing, and supply chain integrity match EUDR requirements. The best practice is to collect the original documents along with the certificates for cross reference.

Risks can change through land-use shifts, political instability, or supplier changes. If your due diligence is not prepared for these changes you can end up underestimating risks.

How to avoid it:

Update your data regularly. Use alerts or satellite monitoring to flag changes near sourcing areas. Maintain ongoing supplier engagement and revisit your assessments at least annually as required by Article 10(4).

In addition to maintaining accurate supplier data, it's essential to stay informed about regulatory updates from the European Commission. This includes monitoring changes to the country risk benchmarking list, updates to compliance requirements, and any published lists of entities found in violation of the EUDR. Staying current ensures your due diligence process remains aligned with the latest legal obligations and enforcement trends.

Even if your due diligence is solid, it won’t hold up without proof. Failing to document your risk assessments, supplier discussions, or mitigation steps compromises the credibility of your process.

How to avoid it:

Create a clear, consistent record-keeping process. Use internal notes, dated files or a dedicated software to show how conclusions were reached. Store all records in a system that supports audit-readiness.

Managing EUDR compliance at scale requires more than spreadsheets and email threads. A reliable software tool should support the full due diligence process from collecting plot-level geolocation data to assessing risk, generating DDS’, and preparing for audits.

Look for a platform that enables you to gather and verify supplier data efficiently, flag risks using built-in logic aligned with Article 10, and track every shipment’s status through to submission. Supplier engagement features, such as portals or mobile-friendly forms, can streamline data collection, while integration with ERP systems helps reduce manual entry.

Most importantly, the tool should provide a clear audit trail and ensure all records are stored for the required five-year period. If your business is navigating additional sustainability obligations, it’s worth considering a solution that also supports broader regulations beyond EUDR.

Coolset helps companies reduce manual workload, improve data quality, and stay ahead of regulatory requirements without the need for complex systems or large compliance teams.

{{product-tour-injectable}}

Explore the Coolset EUDR solution or schedule a live demo with us.

Under the EUDR, due diligence is the mandatory process operators must follow to ensure products are deforestation-free, legally produced, and backed by a DDS. This involves collecting detailed supply chain data, assessing the risk of non-compliance, and taking mitigation measures if the risk is above negligible. Only once compliance is confirmed can a DDS be submitted to the EU system.

The DDS is the final declaration submitted by an operator under the EUDR. It must include:

Each EU Member State designates competent authorities to enforce the EUDR through risk-based audits, inspections, and document reviews. All DDS submissions go into a centralized EU system, where authorities analyze them using risk criteria flagging shipments or operators for closer scrutiny.Customs also play a role by ensuring a valid DDS is provided for imports and blocking non-compliant shipments.

Penalties for non-compliance may include fines (up to at least 4% of turnover), seizure of goods, or suspension from market access. Operators must be ready to show not just the DDS, but the full due diligence system behind it.

No. Certifications cannot replace due diligence under the EUDR, they can only support it. Operators must still collect all required data and perform their own risk assessments.

The European Commission does not recognize any certifications as substitutes for a DDS. Each shipment must be backed by a full due diligence process, regardless of certification status.

Our research team walks you through every step - from supplier engagement to submitting in TRACES.

This free compliance checker scans your packaging documentation and maps it against mandatory PPWR data requirements, giving you a clear view of your compliance status. Get actionable insights on documentation gaps before they become compliance issues.

Get your systems ready for traceability, risk assessment and due diligence.

Based on customer case studies our team has developed a realistic timeline and planning for EUDR compliance. Access it here.